Many participants focus on how to save, but few think about how to withdraw. A thoughtful income strategy in retirement may reduce taxes, provide more flexibility, and increase the longevity of your nest egg. Here are three simple guidelines to keep in mind: 1. Diversify your withdrawal sources Use a […]

Read More

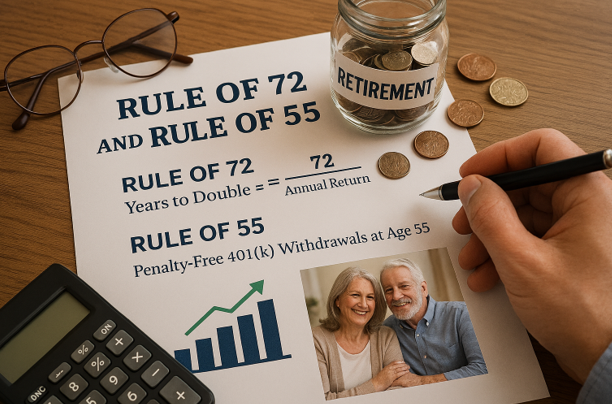

Two Simple Tools for Smarter Retirement Planning When it comes to planning for retirement, a few simple rules can make complex concepts easier to understand. Two of the most helpful are the Rule of 72 and the Rule of 55. Both can give you quick insight into how your savings […]

Read More

How Inflation Can Affect Retirement Savings and Ways to Mitigate Its Impact Planning for retirement is challenging enough, but one factor often underestimated is inflation, the gradual increase in prices over time. Even modest inflation can erode the purchasing power of your savings, meaning the money you’ve set aside may […]

Read More

What is a Collective Investment Trust (CIT)? And How it Differs from a Mutual Fund As a retirement plan sponsor or committee member, you’re probably familiar with mutual funds as the go-to investment option in most 401(k) and 403(b) plans. But you may have also come across Collective Investment Trusts, […]

Read More

Roth 401(k): To Contribute or Not to Contribute? A Comprehensive Comparison Top 7 Reasons to Contribute to a Roth 401(k) 1. Tax-Free Withdrawals Contributions grow tax-free, and qualified withdrawals in retirement are tax-free, providing a tax-free income stream. 2. No Required Minimum Distributions (RMDs) Unlike traditional 401(k)s, Roth 401(k)s […]

Read More

Simple IRA vs 401(k): Should You Consider Upgrading? As your company evolves, your retirement plan should keep pace. If you’re considering upgrading from a SIMPLE IRA to a 401(k), here are the top five advantages and considerations to keep in mind. Top 5 Advantages of a 401(k) 1. Higher Contribution […]

Read More

Staying Ahead: Key Focus Areas for 401(k) Plan Success in 2025 As 2025 begins, 401(k) plan sponsors are entering another dynamic year shaped by fresh regulatory updates, technological advancements, and the evolving expectations of employees. At Rose Street Advisors, our team remains committed to helping you stay ahead, ensuring your […]

Read More

Pros & Cons of Loans and Early Withdrawals from Your Retirement Account When faced with financial needs, taking a loan from your employer-sponsored retirement account, such as a 401(k), can seem like a tempting solution. However, it’s important to understand both the advantages and disadvantages, considering both the short-term and […]

Read More

ERISA Bond vs. Fiduciary Liability Insurance: What Plan Sponsors Need to Know Plan sponsors play a critical role in managing retirement plans, and with this responsibility comes risk. Two essential tools to protect both the plan and the fiduciaries are ERIS bonds and fiduciary liability insurance. Here’s what they are, […]

Read More

Pre-Tax vs. Roth Retirement Savings: What’s the Difference? When it comes to saving for retirement, choosing between pre-tax and Roth savings options is one of the most important decisions you’ll make. Both have unique benefits, and understanding their differences can help you make a choice that aligns with your financial […]

Read More