Many participants focus on how to save, but few think about how to withdraw. A thoughtful income strategy in retirement may reduce taxes, provide more flexibility, and increase the longevity of your nest egg. Here are three simple guidelines to keep in mind: 1. Diversify your withdrawal sources Use a […]

Read More

As a business owner or CFO, you know how important it is to attract and retain top talent. One powerful, but often overlooked, tool for rewarding key employees is a cash balance plan, especially when implemented retroactively for the prior year. What Is a Cash Balance Plan? A cash balance […]

Read More

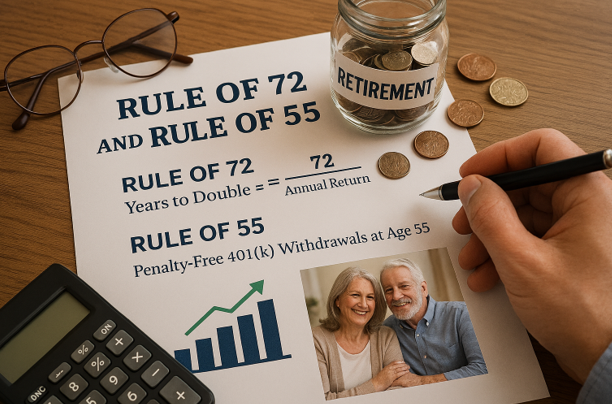

Two Simple Tools for Smarter Retirement Planning When it comes to planning for retirement, a few simple rules can make complex concepts easier to understand. Two of the most helpful are the Rule of 72 and the Rule of 55. Both can give you quick insight into how your savings […]

Read More

How Inflation Can Affect Retirement Savings and Ways to Mitigate Its Impact Planning for retirement is challenging enough, but one factor often underestimated is inflation, the gradual increase in prices over time. Even modest inflation can erode the purchasing power of your savings, meaning the money you’ve set aside may […]

Read More

Pre-Tax vs. Roth Retirement Savings: What’s the Difference? When it comes to saving for retirement, choosing between pre-tax and Roth savings options is one of the most important decisions you’ll make. Both have unique benefits, and understanding their differences can help you make a choice that aligns with your financial […]

Read More